At Hughes Insurance agency we look to provide our clients with informational and educational topics to keep you informed. If there’s a topic you’re interested in and unable to find don’t hesitate to contact us.

Winter-Ready: Protecting Your Home from Seasonal Damage

As temperatures drop, your home becomes vulnerable to winter-related risks. Taking proactive maintenance steps can help prevent potential insurance claims and protect your property from costly damage. Outdoor Maintenance Checklist

How to Slash Your Car Insurance Costs: 9 Smart Strategies

Car insurance premiums have been skyrocketing, with nationwide average increases reaching almost 19 percent. Today, drivers are paying an average of $2,329 annually, with some states seeing premiums exceeding $3,000.

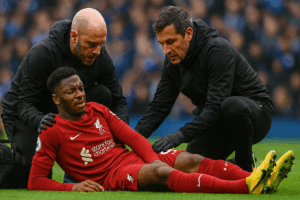

Should College Athletes Buy Disability Insurance?

Kevin Ware’s grisly leg fracture during Louisville’s run to the title was excruciating to watch for anyone—but especially so for NCAA athletes, who were reminded of how quickly and violently

Covered by homeowners insurance? Don’t be so sure

You’ve no doubt noticed that premiums have gotten pretty pricey. Rates have climbed 69% over the past decade to an average of $1,000 a year. What you may not realize

Home Inventory

You come home to everything in ashes. Now what? You have to rebuild everything you had. Where do you start? How good is your memory. I can’t tell you where

Why do I pay so much?

Why did my rate go up? This is probably the question I get more than any other. Did you have any claims? Seems like a simple answer, but most don’t